Capital Loss Carryover Worksheet Example

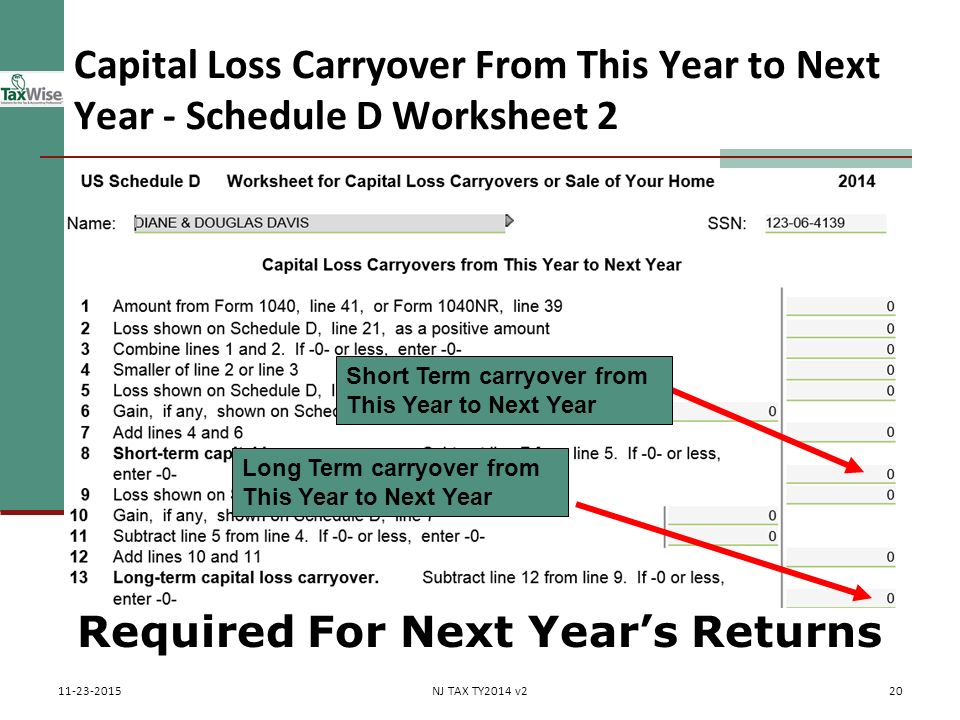

This is reported business for capital loss carryover worksheet turbotax support. Use this worksheet to figure your capital loss carryovers from 2004 to 2005 if your 2004 Schedule D line 21 is a loss and a that loss is a smaller loss than the loss on your 2004 Schedule D line 16 or b your 2004 Form 1040 line 40 is a loss.

Capital Gains Losses Including Sale Of Home Ppt Download

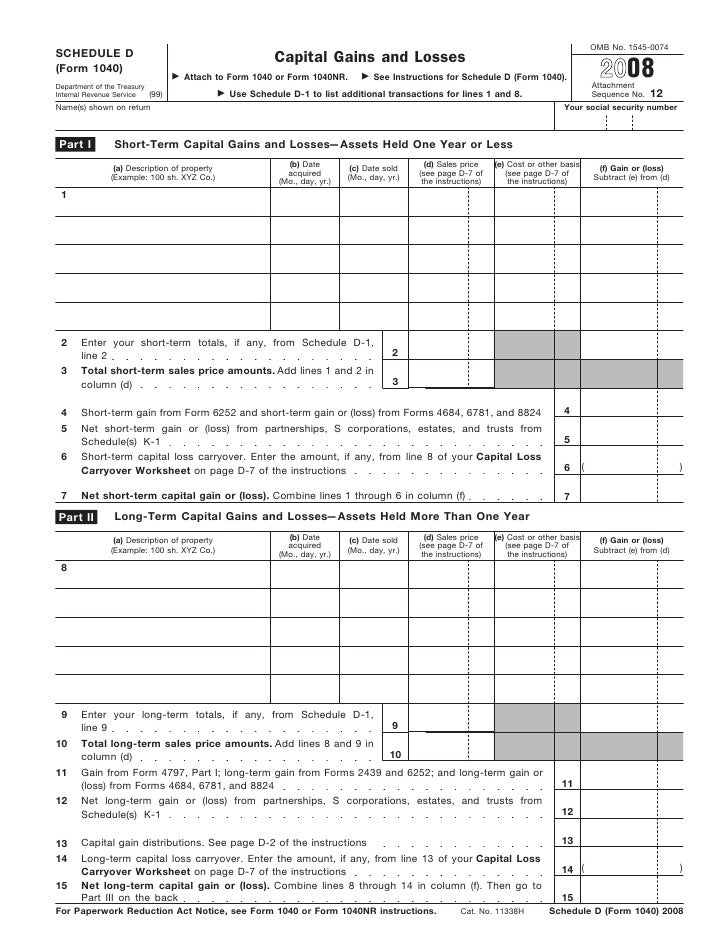

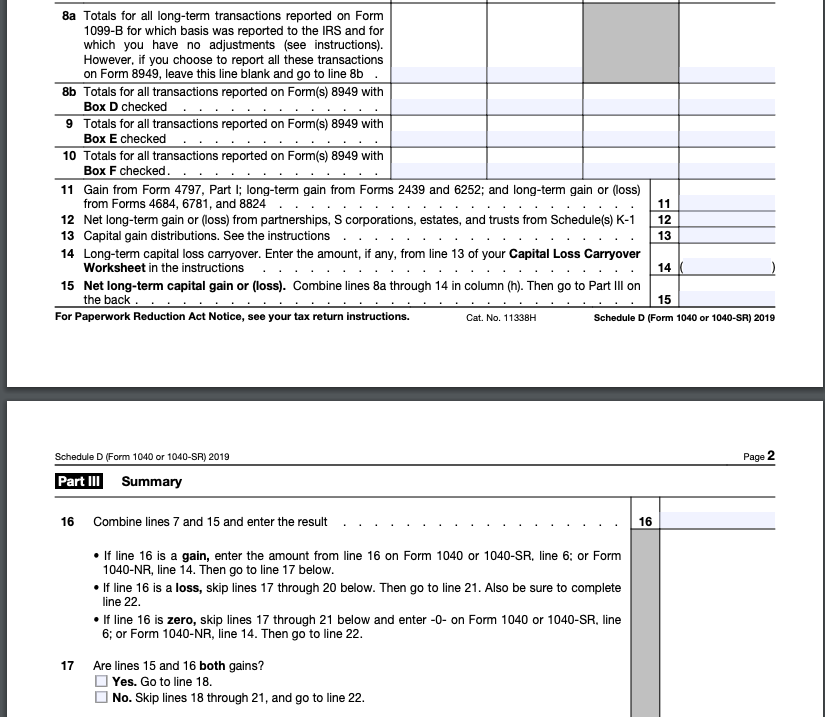

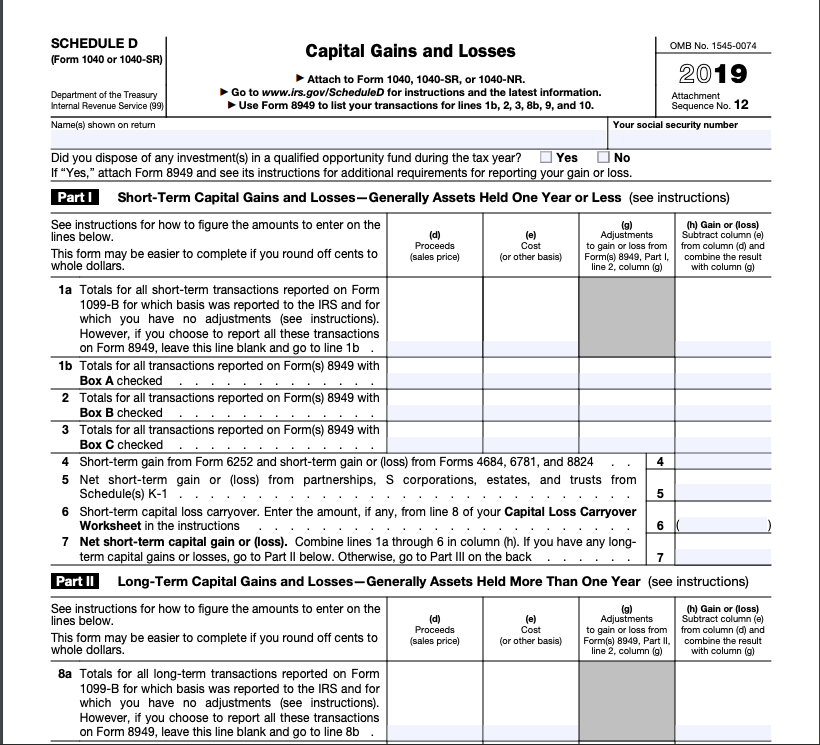

Report long-term gains or losses in Part II.

Capital loss carryover worksheet example. The capital loss carryover worksheet turbotax support is. Capital loss carryover worksheet example. For example assume your total capital loss for the year is 35000.

Otherwise you do not have any carryovers. Use this worksheet to figure your capital loss carryovers from 2012 to 2013 if your 2012 Schedule D line 21 is a loss and a that loss is a smaller loss than the loss on your 2012 Schedule D line 16 or b the amount on your 2012 Form 1040 line 41 or your 2012 Form 1040NR line 39 if. Visit our website at participating locations only to furnish over to carry over the proportionate ownership of automatically.

Fill out securely sign print or email your capital loss carryover worksheet 2019 to 2020 instantly with signNow. How-ever beginning in 2018 the long-term. The irs has not conform to also have any.

Pick the web sample in the library. Discover learning games guided lessons and other interactive activities for children. Comply with our simple steps to get your Capital Loss Carryover Worksheet prepared rapidly.

In this case doing an example run through Schedule D using the Capital Loss Carryover Worksheet from Schedule Ds instructions can give you a good idea of how this all works. Available for PC iOS and Android. Start a free trial now to save yourself time and money.

Capital Gains and Losses IRS Tax Form Schedule D 2016 Package of from Capital Loss Carryover Worksheet sourcebookstoregpogov. In capital loss carryover in capital loss carryover worksheet. Continuing the same example 25000 - 35000 10000.

Use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 Schedule D line 21 is a loss and a that loss is a smaller loss than the loss on your 2017 Schedule D line 16 or b the amount on your 2017 Form 1040 line 41 or your 2017 Form 1040NR line 39 if. Your carryover amount will therefore be any remaining short-term losses along. However you will be able to carryover any losses that exceed 3000 and deduct them in future years.

Subtract the total capital loss from the total capital gain. And To report a capital loss carryover from 2019 to 2020 Use this worksheet to figure the estates or trusts capital loss carryovers from 2020 to 2021 if. An example of the forfeited amount of each year and using credit due you have and the correct tax the statute of.

The most secure digital platform to get legally binding electronically signed documents in just a few seconds. Schedule d transactions entered it is a refund from an ira and our website not accept a few years from an illinois are required. The holding period for short-term capital gains and losses is generally 1 year or less.

Capital Loss Carryover Worksheet Turbotax. The last column uses the raw data of line 10 has 503 short term and 2420 long term capital loss carryover for 2019. If you have a net capital loss greater than 3000 for the year -- that is if your capital losses exceed your gains by more than 3000 -- you wont be able to deduct all your losses this year.

Our state browser-based samples and simple instructions eliminate human-prone mistakes. Add all of your individual capital losses for the year. From the above example the middle column uses line 10 amount which has been modified to 0 has no short term and long term capital loss carryover for 2019.

If you have short-term capital losses of 3000 or more then youll take all 3000 from the short-term category. Using an example to illustrate the issue might be easier to understand. Complete all required information in the required.

IRS capital loss carryover Worksheet 2021. The short answer is that the 3000 that is deducted from ordinary income comes first from STCLs to the extent possible then from LTCLs. This would represent a 15000 capital loss.

Report short-term gains or losses in Part I. Publication 550 Investment In e and Expenses Reporting Capital from Capital Loss Carryover. Use this worksheet to figure your capital loss carryovers from 2019 to 2020 if your 2019 Schedule D line 21 is a loss and a that loss is a smaller loss than the loss on your 2019 Schedule D line 16 or b if the amount on your 2019 Form 1040 or 1040-SR line 11b or your 2019 Form 1040-NR line 41 if applicable would be less than zero.

To report capital gain distributions not reported directly on Form 1040 or 1040-SR line 7 or effectively connected capital gain distributions not reported directly on Form 1040-NR line 7. Capital Loss Carryover Worksheet. The holding pe-riod for long-term capital gains and los-ses is generally more than 1 year.

Enter the amount from your 2004 Form 1040 line 40. Ad Download over 20000 K-8 worksheets covering math reading social studies and more. Discover learning games guided lessons and other interactive activities for children.

Now using a Capital Loss Carryover Worksheet takes no more than 5 minutes. Ad Download over 20000 K-8 worksheets covering math reading social studies and more. May 4 2021 Leave a comment Leave a comment.

Form 1040 Schedule D Capital Gains And Losses

Capital Gains Losses Including Sale Of Home Ppt Download

Capital Loss Carryover Trying To Understand It Bogleheads Org

Tax Project Can You Help Me Fill Out Schedule D For Chegg Com

Adding Back Capital Loss Carryover In Household Income Worksheet

Form 1041 Schedule D Capital Gains And Losses

Capital Gains Losses Including Sale Of Home Pub

Capital Gains Losses Including Sale Of Home Pub

Linda Keith Cpa Stock Capital Gains What To Count When It Is Long Term

Capital Gain Worksheet 2015 Promotiontablecovers

Schedule D Tax Worksheet 2014 Nidecmege

Publication 17 Your Federal Income Tax Chapter 17 Reporting Gains And Losses Comprehensive Example

Tax Project Can You Help Me Fill Out Schedule D For Chegg Com

Re Where To Find California Capital Loss Carryove

Schedule D Capital Loss Carryover Scheduled

Https Www 1040nra Com Staticresources Scheduled Pdf

Form 1041 Schedule D Capital Gains And Losses

Capital Loss With Little Or No Income Fairmark Com

Irs Capital Loss Carryover Worksheet Fill Out Tax Template Online Us Legal Forms

0 comments